There are a few changes this year that will impact your employee’s tax return, and could affect their take home pay in the next financial year.

This article provides general advice and may not be relevant to your circumstances.

Death and taxes might be inevitable, but if the past 18 months has taught us anything it’s that things can be turned upside down in an instant and knowing how to embrace a new way of doing things becomes essential.

This year’s EOFY is accompanied by changes to tax brackets, an increase to the minimum wage and an alternative to the WFH shortcut that might provide a better result.

HRM asked three experts what pitfalls might await HR professionals this year, and how to avoid them.

1. Backdated tax cuts

Last year, the federal government brought forward its proposed tax cuts to 1 July. However, the legislation wasn’t passed until October 2020, meaning there was roughly a four-month period where employees paid the existing tax amount.

“The pay as you go (PAYG) withholding schedules were adjusted for these changes, but they only apply from the date that they were changed,” says Susan Franks, senior tax advocate at Chartered Accountants ANZ.

“This means that some employees will have had too much tax deducted from their wages in the first part of the year and may receive a tax refund when they lodge their income tax return.”

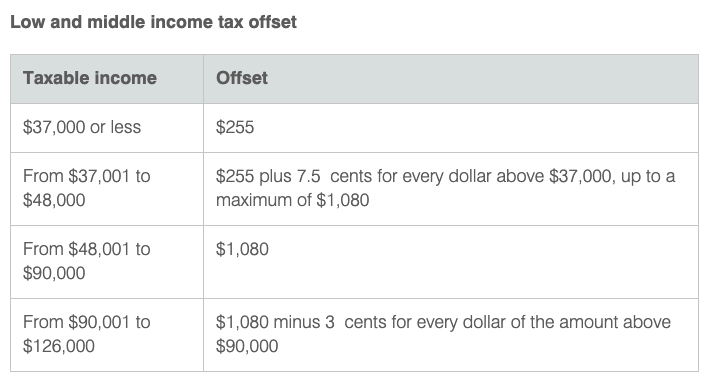

The other tax cut to be aware of, says Franks, is the extension of the low and middle income tax offsets (LMITO).

“The LMITO is not incorporated into the PAYG withholding schedules,” she says, “As a consequence, if you are entitled to the LMITO you will need to lodge your return to receive the tax offset.”

Employee’s don’t need to complete any additional forms to claim the LMITO. The ATO will calculate this for them when they lodge their tax return.

“If you think of HR as strategy and payroll as execution, they need to be working together to make this change as smooth as possible.” Tracy Angwin, CEO of the Australian Payroll Association

2. The minimum wage increase

The minimum wage was increased by 2.5 per cent just last week, after the Fair Work Commission’s Annual Wage Review.

However, unlike previous minimum wage increases, only some awards will receive the raise as of 1 July. For employees under the retail award the change comes into effect after 1 September. While other industries heavily impacted by COVID-19, such as those in the airline industry, won’t see a wage increase until November 2021.

“This will mean a lot more admin work for payroll,” says Tracy Angwin, CEO of the Australian Payroll Association.

“For example, if you’re a retailer in the amusement and entertainment industry [with a mixed workforce], let’s say, then you might have some employees getting the 1 July raise and others under the general retail award getting it in September. And others under the Amusement, Events and Recreation Award getting it two months later.”

HR can assist payroll in this circumstance by creating clear communications for employees about when they will receive a pay rise, if they’re eligible, says Angwin.

This could create an administrative headache for some businesses, so it’s important different departments work together.

“If you think of HR as strategy and payroll as execution, they need to be working together to make this change as smooth as possible,” she says.

3. Superannuation increase

Another change to be aware of is the mandatory superannuation increase from 9.5 to 10 per cent occurring on 1 July. This change will have a big impact on employers but for those who want to help ensure employees have a healthy nest egg come retirement HR could encourage voluntary donations.

There are some benefits to making a voluntary contribution before the end of the financial year and, as part of strengthening your people’s financial literacy, you could point them in the direction of a financial expert who can offer more details.

“A little-known feature of the tax system is that in many cases you can often voluntarily send extra money to your superannuation, then claim a tax deduction for the difference,” says Franks.

“For example, if you earn the average wage of about $89,000 in Australia, you are paying 32.5 cents in tax for most of the dollars you earn. For most people however, superannuation is only taxed at 15 per cent.”

In this instance, for every voluntary dollar employees contribute, they can claim a 17.5 cent deduction to make up the difference. The voluntary contribution must come from taxed income. Salary sacrifices and contributions made by an employer do not count.

For HR professionals, Angwin says to tread lightly when discussing this option with employees. Firstly, it is illegal for HR to provide financial advice. And secondly, you may not have all the information about an employee’s income sources, so providing advice based on your mandatory contributions could be misleading.

“If an employee wants to make additional contributions to their super all you can do is tell them what contribution you as the employer have made on their behalf and leave them to discuss the rest with a professional,” says Angwin.

4. Understanding WFH costs

Last year the Australian Tax Office (ATO) introduced the ‘shortcut method’ for employees to claim deductibles on home office costs. The shortcut method aims to simplify these deductions by rolling depreciation costs and utility expenses, such as phone, internet, electricity, heating and cooling, into one.

Employees will need to provide evidence that they worked from home during the hours they claim. Timesheets, rosters and diaries are acceptable forms of proof, according to the ATO.

To claim this, employees need to work out how many hours they worked remotely between 1 July, 2020 and 30 June, 2021. They then multiply this by 80 cents to find the deductible amount.

However, Mark Chapman, director of tax communications at H&R Block, isn’t convinced this is the best method for those primarily working from home.

“Another method called the fixed rate method, or 52 cent method, is worth considering,” he says.

“You get 52 cents for every hour you worked from home, but in addition you can claim things like phone and internet costs and the depreciation on your computer. This is likely to add up to a larger claim at the end of the day.”

Similar to the shortcut method, employees need to provide evidence (such as a timesheet) to prove they worked from home during the hours they’re claiming the 52 cents for.

Other deductibles such as phone and internet expenses, stationery costs and the decline in value of equipment, will need to be calculated separately. Employees may need to provide receipts and utility bills as evidence of these costs.

Final HR EOFY advice

Our experts share some extra points HR should consider coming into the EOFY, including:

-

- Be organised – “When you are discussing pay increases or bonus, consider not only the impact on employers but employees,” says Franks, “Consider questions such as ‘Are they likely to want to salary sacrifice their bonus or increase super contributions?’ and ‘Will there be enough time for them to do so before [financial] year end’. Having these conversations early can help.”

- Remind employees to double check pre-filled data on their tax return – “Many third parties, such as banks, won’t pass information about you to the ATO until late July or early August, so early lodgers who use the ATO’s myTax system will often find lots of data missing from their pre-fill,” says Chapman, “If you omit income and get questioned by the ATO, the legal burden will be on you, even though you’ve taken the information straight from the ATO’s systems.”

- Consider using the new year to brush up your skills – “Getting a better understanding of payroll can really help HR professions,” says Angwin, “It allows you to work closer with payroll staff, but also think of the data you can pull from payroll systems if you understand them. It can help you make more informed decisions.”

Outside of taxes and superannuation changes, the end of the financial year is often a transitional time for organisations and employees alike.

Employers might want to use this time to review employment contracts, go over employee benefits or even revisit your organisation’s mission statement.

Employees may also be reconfiguring their own finances and might ask for a pay rise or look to going part-time, so it’s worth preparing managers for these conversations.

Looking to upskill for the next financial year? Check out AHRI’s selection of short courses. Available online and in person.

Really helpful and useful advice.

Great input, short & sweet steps! I can clearly provide this to my blue collar workforce and it will make sense. Thank you!